Real estate property owners in Germany: Beware of the CO2 tax cost trap

At the beginning of 2021, the German national emissions trading system, hereafter "nEHS" (Brennstoffemissionshandelsgesetz – BEHG) started, introducing the pricing of CO₂ emissions for the heating and transport sectors.

The principle is simple: for every tonne of CO₂ that is emitted from the combustion of oil and gas, an "nEHS" certificate must be surrendered. From January onwards, CO₂ tax on the consumption of oil and gas in a property will no longer be borne solely by tenants. Landlords will also be asked to pay.

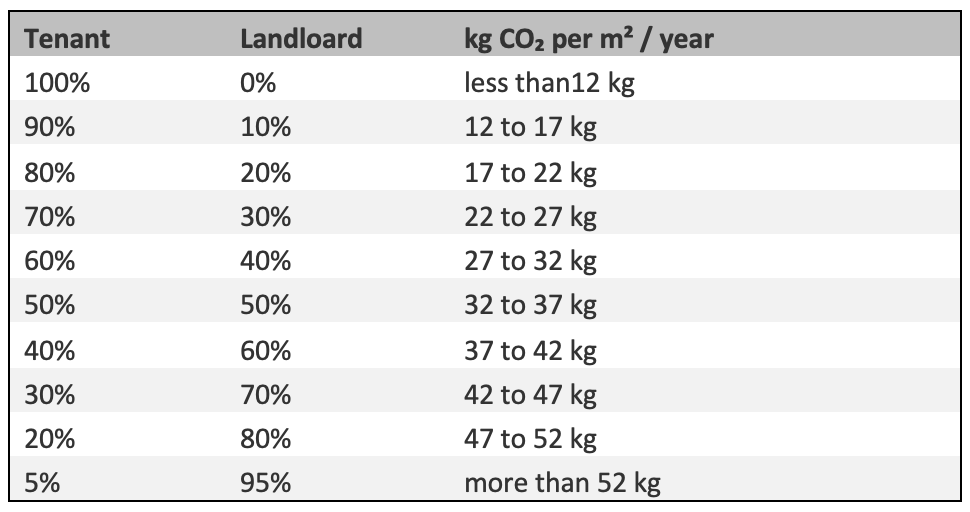

The lower the energy efficiency rating of the building, the higher the share of tax to be incurred by the landlord. How much the landlord will ultimately have to pay will vary and depends on the amount of CO₂ emissions per square metre of the building. For flats with a particularly poor energy efficiency rating, landlords are to bear 95 per cent and tenants five per cent of the CO₂ tax for instance, as shown below.

The CO₂ tax will therefore have a particularly heavy impact on properties that have not yet been renovated in terms of energy efficiency. Thus the policy increases the pressure on property owners to invest in the energy-efficient refurbishment of their building stock.

This model is to apply to all building classes, including residential, retirement and nursing homes, hospitals and mixed-use buildings using fuels covered under the"nEHS". For commercial premises, a 50/50 rule is applied.

The original pricing of the CO₂ tax in the "nEHS" was adjusted in November 2022 due to the high energy price crisis. In the introductory phase, emission CO₂ tax for combustion-related CO₂ emissions of 1 t are sold at a fixed price.

- in the period 01.01. to 31.12.2021 for 25 euros,

- in the period 01.01. to 31.12.2022 for 30 euros,

- in the period 01.01. to 31.12.2023 for 30 euros (originally: 35 euros),

- in the period 01.01. to 31.12.2024 for 35 euros (originally: 45 euros),

- in the period 01.01. to 31.12.2025 for 45 euros (originally: 55 euros) and

- for the year 2026, there is a price corridor with a minimum price of 55 euros per emission allowance and a maximum price of 65 euros per emission allowance.

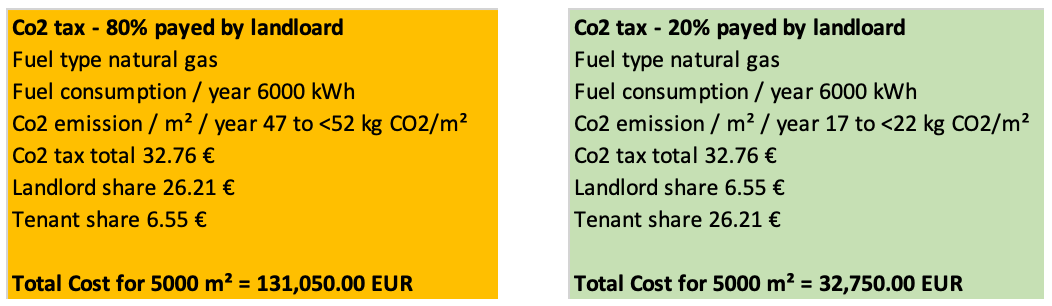

This will mean practically that in case of a building with CO₂ emissions / m² / year of 47 to <52 kg CO₂/m² the landlord has to pay with 5000m2 131,050.00 EUR.New Paragraph

Compared with 32,750.00EUR, when the CO₂ emission / m² / year are 17 to <22 kg CO₂/m². What options lie in front of you as a property owner targeted by the CO₂ tax? For instance:

The landlord-to-tenant electricity model:

Via the landlord-to-tenant electricity model (Mieterstrommodel), electricity could be generated in the immediate vicinity of the apartment building and offered to tenants for consumption under a tenant electricity contract. It can be produced by various methods, such as small wind turbines, “co-generation” combined heat and power plants. Mostly, however, photovoltaic systems are used to generate tenant electricity, as the solar electricity produced is favoured by the Renewable Energy Sources Act.

The Energysprong principle:

The Energysprong principle rethinks renovation: a simple, fast, and economically feasible product with NetZero standard that will enable climate-friendly renovation and living for everyone. The refurbishment time is reduced to a few weeks so that residents are only minimally affected. This is made possible by prefabricated façade and roof elements as well as standardised, prefabricated building services modules. For landlords, this has the advantage that tenants do not have to move out and thus no rent bust occurs. The high degree of prefabrication and optimised processes reduce construction costs. In addition, an attractive business case is created for housing companies, in which the renovation costs are financed through the energy costs saved.

Should you like to know more about how you can upgrade your real estate portfolio in a non-cost intrusive and ESG compliant way, feel free to reach out to us. EnerSave Capital and its Partner Network offer all of the services you need to find the best solutions to help you with your energy transition such as:

- ESG advisory services

- EU grant preparation advisory services

- Carbon solutions

- Securitization of sustainability themed assets

- Corporate finance services relating to sustainability themed opportunities

- Capital market services

- Matchmaking between, asset owners, technology providers and financiers.