News

We were proud to see our Chairman hosted by the World Green Building Council in Brussels, where key voices gathered to address the future of the built environment. One message came through loud and clear: data is the foundation of effective building decarbonization. Reliable, accessible data is essential, meaningful action cannot move forward without it. Standardization is key, harmonized metrics and methodologies across the EU are critical for comparability, scalability, and real impact. Simplicity matters, clear, straightforward reporting and measurement empower municipalities, SMEs, and stakeholders to act with confidence. This discussion underscored our shared commitment to unlocking the power of data in the fight against climate change.

From 4–6 June 2025, the REHVA HVAC World Congress CLIMA gathered global leaders in Milan for the 15th edition of the world’s premier scientific event dedicated to heating, ventilation, and air conditioning (HVAC). This year's theme "Decarbonized, healthy, and energy-conscious buildings in future climates" spotlighted the critical role of HVAC technologies in achieving sustainable, resilient, and occupant-focused buildings. Our team was honoured to take part in this high-level congress, contributing to the international dialogue on climate adaptation, energy performance, and indoor environmental quality. With a strong emphasis on innovation, integration, and policy alignment, CLIMA 2025 provided a valuable platform to engage with industry experts, researchers, and policy leaders from across Europe and beyond. Participation in events like CLIMA reinforces our commitment to advancing solutions that support decarbonisation goals, healthier indoor environments, and a more energy-efficient built environment for all.

From March 24–26, 2025 , ChangeNOW returned to Paris as the world’s largest event for solutions addressing climate, biodiversity, and social impact. Among the global changemakers, investors, and innovators, our Chairman, Csaba de Csiky, was honoured to join a high-level discussion panel focused on sustainable urban transformation and financing the energy transition . ChangeNOW serves as a vital platform to connect groundbreaking ideas with practical implementation, bringing together mission-driven leaders who are actively shaping a more resilient and inclusive future. Our Chairmain’s participation highlighted our commitment to rethinking how cities are financed and developed, bridging the gap between impact investment , climate action , and affordable housing . His insights contributed to an urgent dialogue on aligning financial tools with environmental and social goals at scale. As ChangeNOW 2025 reaffirmed, collaboration across sectors is key to delivering the systemic change our planet and cities need.

On 7–8 May , our Chairman, Csaba de Csiky, participated in the International ESCO Symposium in Istanbul, joining industrial leaders, innovators, and policymakers who are shaping the future of energy efficiency across Europe and beyond. His contribution to the discussions reflected a shared commitment to accelerating the green transition through integrated solutions that unite environmental ambition with economic opportunity. Events like the ESCO Symposium play a vital role in strengthening cross-border collaboration and highlighting cutting-edge approaches to sustainable energy use. Our presence in Istanbul reaffirms our dedication to advancing energy efficiency, innovation, and impactful policy in the built environment.

9-13 March 2025 Palais des Festivals, Cannes, France MIPIM Cannes: Shaping the Future of the Built Environment We were proud to take part in MIPIM, the world’s leading real estate event held annually in Cannes, where global decision-makers, innovators, and urban visionaries gather to accelerate the transformation of the built environment. More than just a trade fair, MIPIM is a week-long urban festival that brings together key players across property, investment, architecture, and sustainability. With a strong focus on innovation, climate resilience, and social impact, MIPIM offers a powerful platform to showcase pioneering ideas, form strategic partnerships, and influence the cities of tomorrow. MIPIM not only as a space for networking, but as a catalyst for real change, where bold visions for housing, infrastructure, and energy efficiency are shared and shaped. Our participation reinforces our commitment to driving forward inclusive, sustainable urban development in Europe and beyond.

After an unintentional break, the MCE is back. The MCE is the most prestigious showcase for companies in the HVAC+R, renewable energy and energy efficiency sectors. This year is a special edition for EnerSave Capital as we are also officially representing The Sustainable Energy Finance Association (SEFA) as we are one of the founding members. Stagnant supply chains, the looming collapse of the global economy, rising interest rates and the current record-breaking inflation make it more necessary than ever to unite the efforts of the entire industry to counteract climate change. EnerSave Capital and SEFA will be in Milan for the next few days to continue working with our customers on tomorrow's solutions to make our contribution to the fight against climate change.

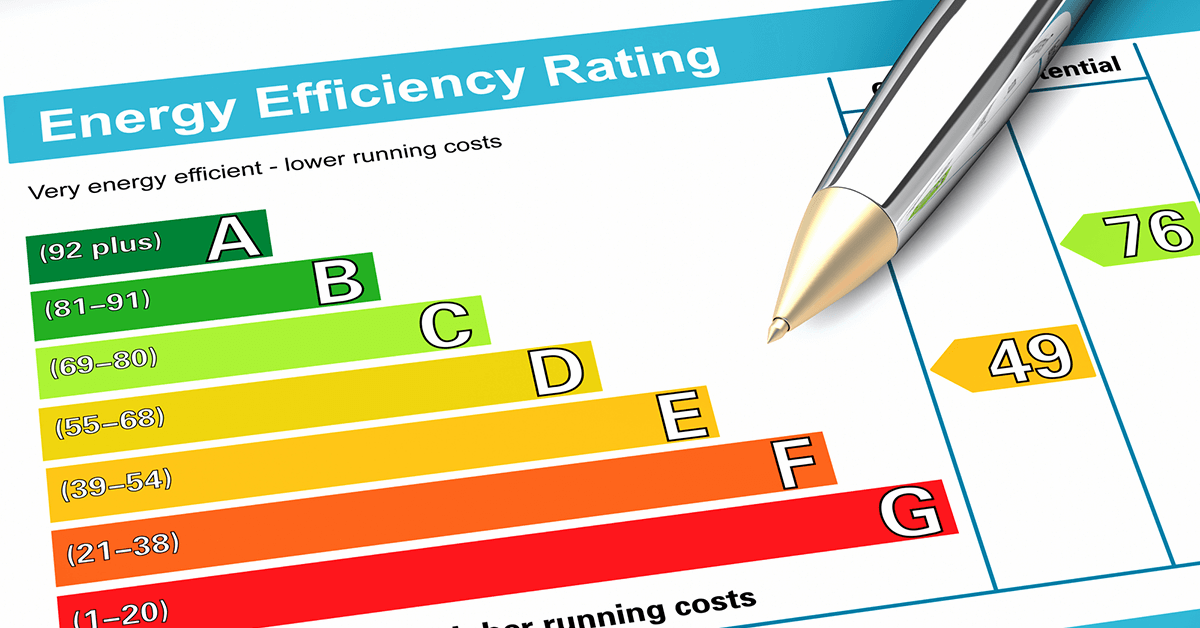

At the beginning of 2021, the German national emissions trading system, hereafter "nEHS" (Brennstoffemissionshandelsgesetz – BEHG) started, introducing the pricing of CO₂ emissions for the heating and transport sectors. The principle is simple: for every tonne of CO₂ that is emitted from the combustion of oil and gas, an "nEHS" certificate must be surrendered. From January onwards, CO₂ tax on the consumption of oil and gas in a property will no longer be borne solely by tenants. Landlords will also be asked to pay. The lower the energy efficiency rating of the building, the higher the share of tax to be incurred by the landlord. How much the landlord will ultimately have to pay will vary and depends on the amount of CO₂ emissions per square metre of the building. For flats with a particularly poor energy efficiency rating, landlords are to bear 95 per cent and tenants five per cent of the CO₂ tax for instance, as shown below.

Thank you for joining Part 1 of our Two-Part Webinar Series "Lessons Learnt from Supporting the Processing of €150m of Sustainable Energy Asset Deals". The focus was on specific case studies from Alistair Brown of LUMENSTREAM and Peter Radford of Amber Infrastructure Limited to review their experiences and key learnings from LAUNCH, and we introduce the PROPEL project, a successor project to LAUNCH What we have learned so far: The key factors that led to LAUNCH’s success with financing and deal closure Experience bundling and financing projects from a project developer The point of view of a financial fund on financing energy efficiency How you can actively engage within PROPEL

After an unintentional break, the MCE is back. The MCE is the most prestigious showcase for companies in the HVAC+R, renewable energy and energy efficiency sectors. This year is a special edition for EnerSave Capital as we are also officially representing The Sustainable Energy Finance Association (SEFA) as we are one of the founding members. Stagnant supply chains, the looming collapse of the global economy, rising interest rates and the current record-breaking inflation make it more necessary than ever to unite the efforts of the entire industry to counteract climate change. EnerSave Capital and SEFA will be in Milan for the next few days to continue working with our customers on tomorrow's solutions to make our contribution to the fight against climate change.